- TemplatesTemplates

- Page BuilderPage Builder

- OverviewOverview

- FeaturesFeatures

- Dynamic ContentDynamic Content

- Popup BuilderPopup Builder

- InteractionsInteractions

- Layout BundlesLayout Bundles

- Pre-made BlocksPre-made Blocks

- DocumentationDocumentation

- EasyStoreEasyStore

- ResourcesResources

- DocumentationDocumentation

- ForumsForums

- Live ChatLive Chat

- Ask a QuestionAsk a QuestionGet fast & extensive assistance from our expert support engineers. Ask a question on our Forums, and we will get back to you.

- BlogBlog

- PricingPricing

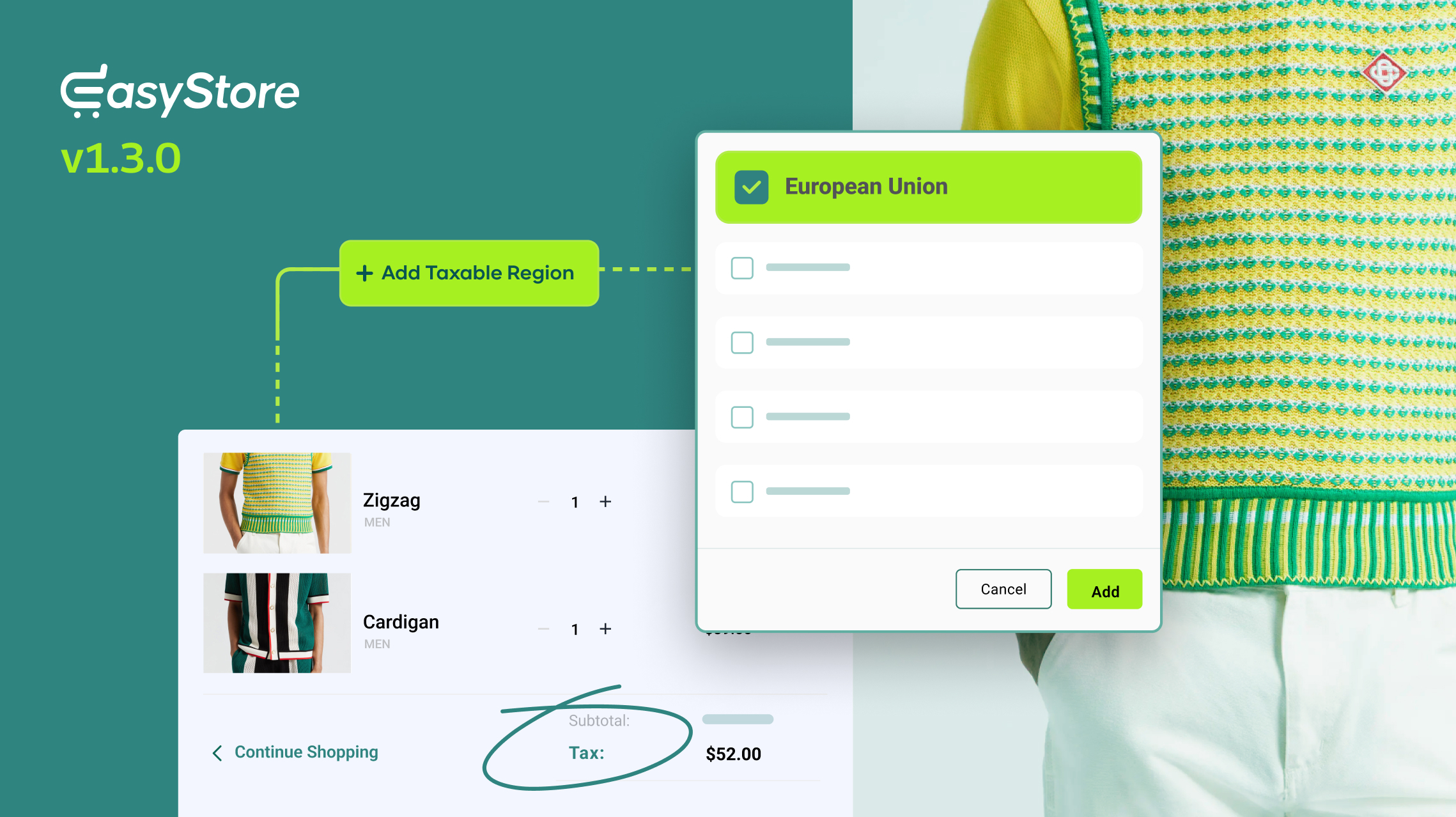

EasyStore v1.3.0: Redesigned Tax Settings for Effortless EU Tax Management

The moment you've been waiting for has arrived – the new and improved tax management system is here for you to experience!

All our users, especially from the EU, can now rejoice, as this highly anticipated tax update is set to add a new dimension to your Joomla online store. Get set for a smarter, more efficient tax management system, featuring far more intuitive and user-friendly controls.

Hang tight as we take you on this ride to discover what’s new in our revamped tax settings.

EasyStore v1.3.0 Changelog:

- New: Introduced redesigned Tax System with EU tax support.

- New: Added option to display product price with tax.

- Update: Updated missing language string for all language package.

- Fix: Fixed stateless country validation issue on the checkout page.

What’s New in the Overhauled Tax Management System

We totally get how complicated tax setup can be across different countries and regions. That’s why we set out to make regional tax settings, especially for our EU users, easier and more streamlined.

Thanks to our awesome users who stepped up to identify the necessary fixes and improvements to make this system even better. Together, we came up with a fresh approach to reinvent the tax system—one that benefits both EU users and everyone around the globe!

- Seamlessly set the EU as your designated tax region.

- Enjoy compliance with the One-Stop Shop integration.

- Micro-Business Exemption for small-scale businesses.

- Adjust VAT rates for various categories using Product Tax Overrides.

- Calculate shipping taxes based on customer location.

- Apply uniform rules to the tax configuration with Global Tax settings.

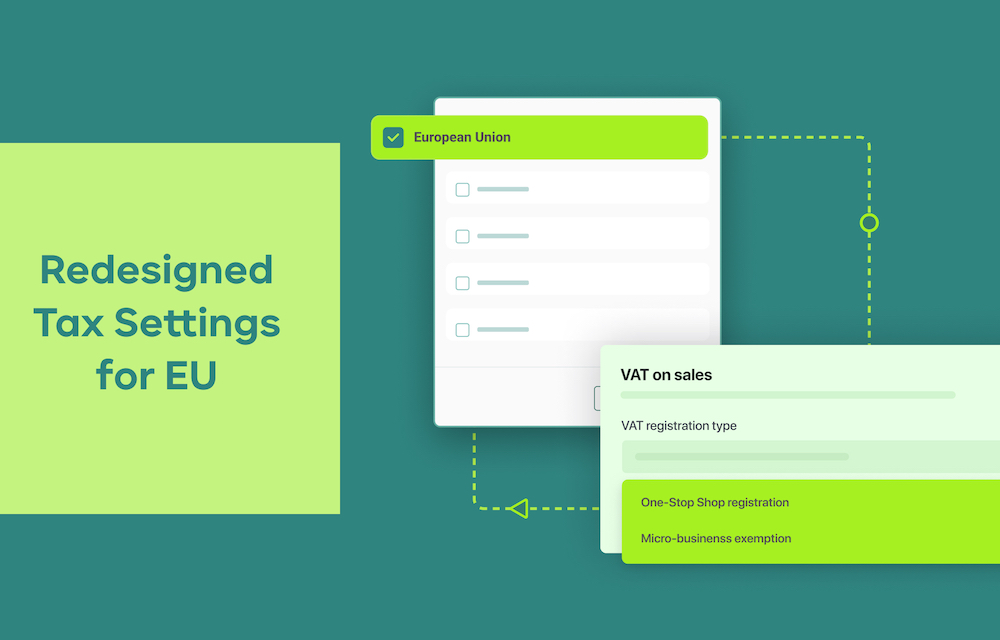

Redesigned Tax Management for EU Users

EasyStore now makes it effortless to handle cross-border VAT for our EU users. It's all thanks to the introduction of OSS and the Micro-Business Exemption, our revamped system makes VAT compliance across multiple regions a breeze, allowing you to focus on your business without any hassle.

If you previously set up tax rates for individual EU countries, please review and adjust your settings to take advantage of the new OSS system or Micro-Business Exemption. This will ensure that your tax rates remain accurate and compliant under the updated system.

One-Stop Shop Registration

EasyStore now gives merchants the option to use the One-Stop Shop (OSS) for their online store, making it a game-changer for those selling across EU countries. With OSS (One-Stop Shop Registration), you can easily manage VAT compliance by registering in just one EU country, allowing you to handle VAT for all your cross-border sales. Plus, you can easily enter VAT rates for each EU country where you sell, streamlining your tax setup and ensuring compliance with ease.

Micro-Business Exemption

We have also introduced the Micro-Business Exemption system in our new tax settings! This feature is designed to empower small businesses by allowing those with lower sales volumes to enjoy simplified tax compliance. If your business qualifies, you can take advantage of this exemption to focus more on growth and less on complex tax regulations. With the Micro-Business Exemption, you can apply your home country’s VAT rate to all sales within the EU, making tax management even simpler!

And here’s the best part: once your sales exceed the threshold for the Micro-Business Exemption, you can easily upgrade to the One-Stop Shop (OSS) system.

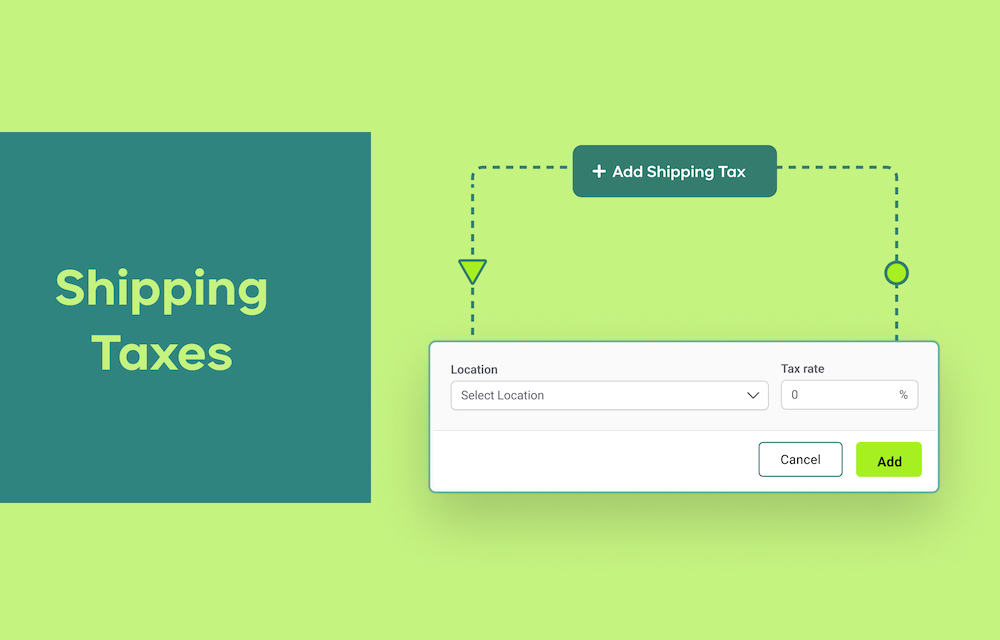

Flawlessly Implement Shipping Taxes

The revamped Shipping Tax calculation also takes the stress out of shipping taxes! In line with local VAT regulations, you can now easily apply taxes to delivery costs. In some EU countries, both products and shipping fees are taxable. With EasyStore, configuring shipping tax rates is a breeze, ensuring full compliance while boosting efficiency.

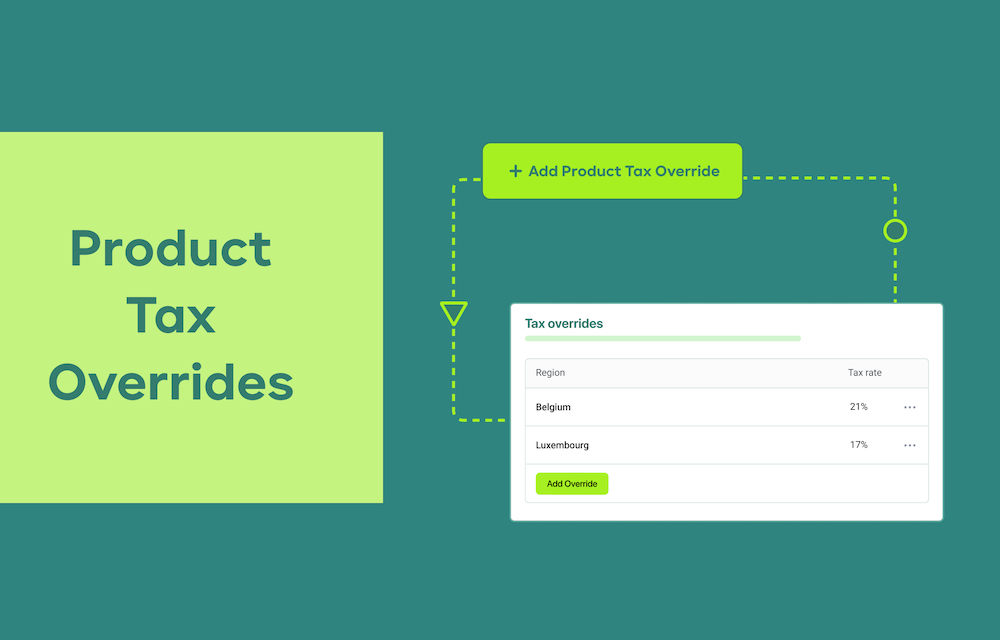

Product Tax Overrides for Maximum Flexibility

Here is something to further maximize the flexibility with EasyStore—Product Tax Overrides! Whether you're selling essentials or reduced-rate goods, you can easily assign custom VAT rates to ensure full compliance with local tax regulations. All you have to do is select the product category, add the location and corresponding tax rates, and voilà, you're all set!

Simplified Global Tax Settings for a Better Shopping Experience

In addition to the features we've covered, you’ll also benefit from global tax settings that apply to your overall tax settings. Here’s what’s more:

- Tax is Already Included in Product Price and Shipping Rate: Give your customers transparency with prices and shipping fees that already include taxes. No surprises at checkout—what they see is the final price!

- Tax Calculated and Displayed at Checkout: Taxes are automatically calculated at checkout based on the customer’s shipping address, ensuring accuracy every time.

- Display Prices Inclusive of Tax: Make pricing clear by showing tax-inclusive prices on your site.

- Charge Shipping Tax: Choose to apply or exclude your shipping tax rates across the regions you've configured.

Check out our detailed documentation to learn more about the features.

Update Now!

So why wait? Upgrade to this brand-new version today and take your Joomla store to the next level. Boost productivity, save time, and streamline your tax processes with ease. And lastly, don't forget to share your valuable thoughts in the comments!

Start thriving with EasyStore today!

LS

lucie sulerka

it's just the little things. the priority must be completed functions to be able to add the product to more categories. a product can still only be entered in one category. that's amateurism.

#14036