- TemplatesTemplates

- Page BuilderPage Builder

- OverviewOverview

- FeaturesFeatures

- Dynamic ContentDynamic Content

- Popup BuilderPopup Builder

- InteractionsInteractions

- Layout BundlesLayout Bundles

- Pre-made BlocksPre-made Blocks

- DocumentationDocumentation

- EasyStoreEasyStore

- ResourcesResources

- DocumentationDocumentation

- ForumsForums

- Live ChatLive Chat

- Ask a QuestionAsk a QuestionGet fast & extensive assistance from our expert support engineers. Ask a question on our Forums, and we will get back to you.

- BlogBlog

- PricingPricing

Taxes

Managing tax compliance within the European Union (EU) is crucial for eCommerce businesses selling to EU customers.

EasyStore simplifies this process by allowing you to set up and manage Value-Added Tax (VAT) for all regions including EU countries, ensuring accurate tax rates and compliance with local regulations.

This documentation will guide you through configuring taxes, including VAT registration types, applying VAT rates, and setting up regional variations.

Note: You need to select Charge Tax while creating your product in order to make tax applicable to the product. For detailed instructions, refer to the product documentation.

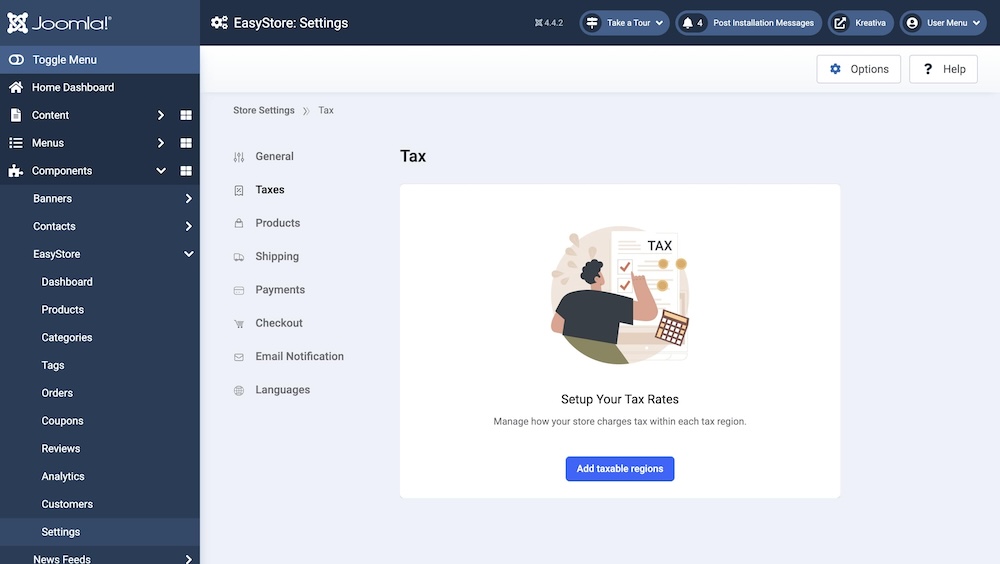

How to Access Tax Settings

- To access the tax settings, go to Components > EasyStore > Settings > Taxes.

- Here, click on the “Add taxable regions” to set up both Regional Tax Rates and Global Tax Settings.

Regional Tax Rates

Note: Please consult with your local tax authorities to ensure you are applying the correct tax rates to your customers.

Regional taxes apply based on specific geographical areas, such as states or provinces, ensuring compliance with local tax laws. These taxes are crucial for applying accurate charges based on the customer's location. For example, in the U.S., state sales tax rates differ, so the correct regional tax must be applied based on the shipping or purchase location.

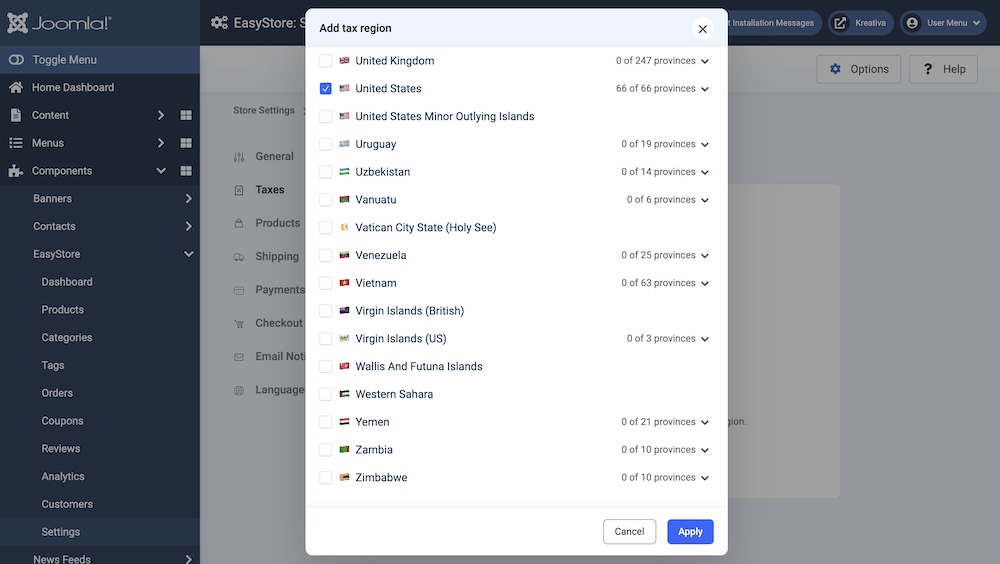

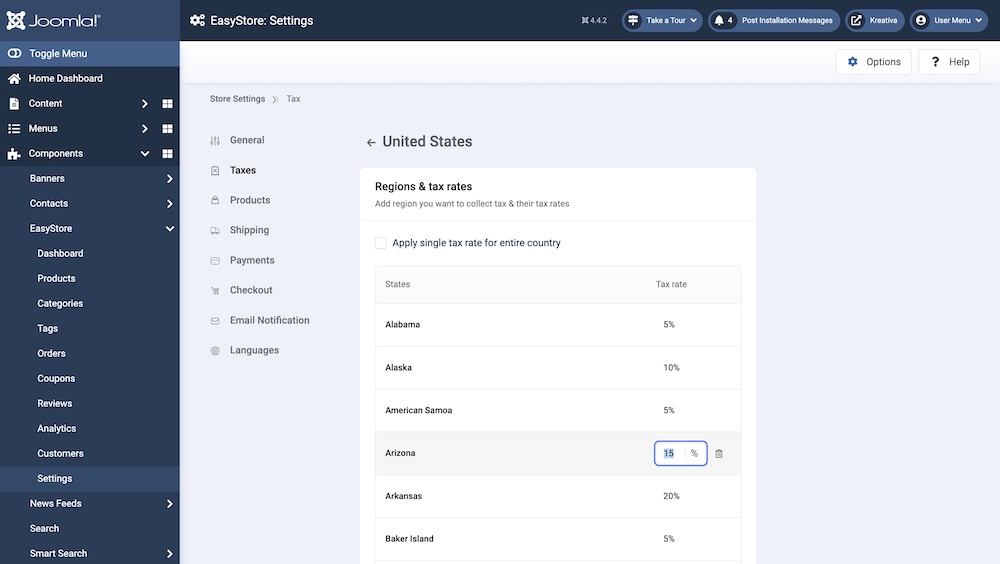

To Set up Regional Taxes:

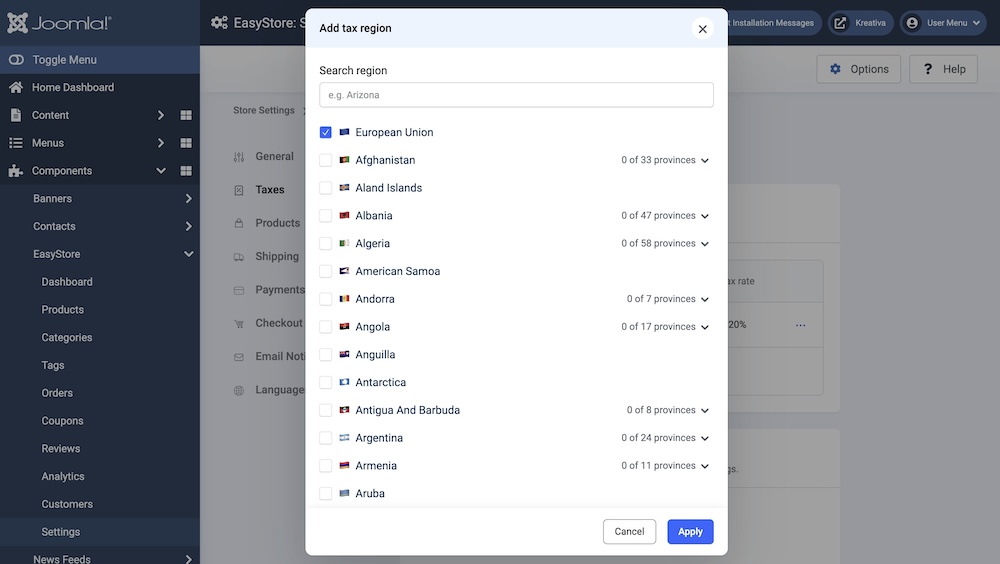

- Click on the Add Region button under Regional Tax Rates.

- Select the required country from the dropdown menu and click Apply.

- Choose whether to apply a uniform rate across the country or different rates for each state or region.

- Enter the desired rate in the Tax Rate field and click Save Changes.

Setting up Taxes in the European Union

Click on the Add Region button under Regional Tax Rates. Select the European Union from the dropdown menu and click Apply.

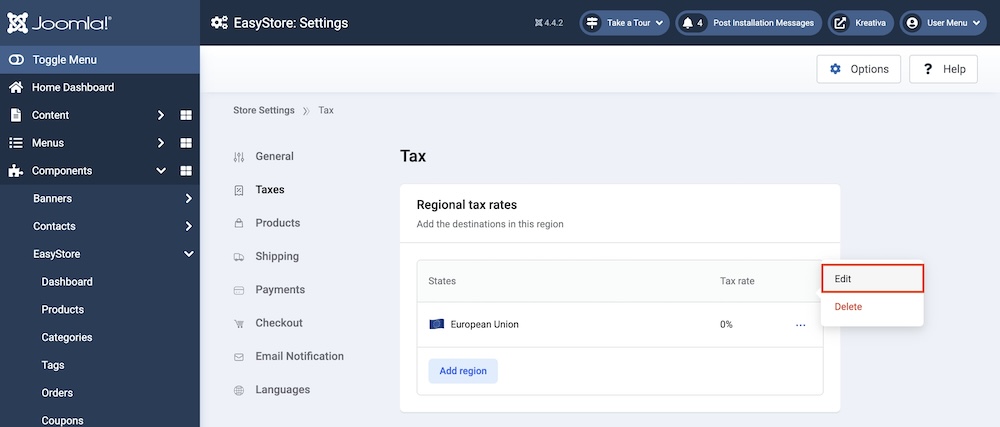

Click on the three-dot ellipsis icon to the right of the region. Select Edit from the dropdown menu.

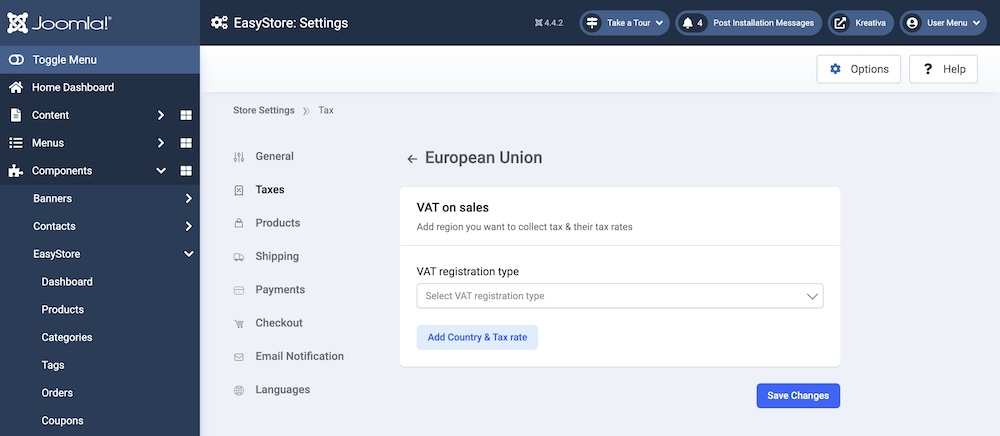

Once inside the VAT on Sales section, you can configure VAT details for the European Union.

Configuring VAT Options for the European Union

VAT (Value-Added Tax) applies to most products and services sold within the EU. VAT rates vary between member countries, with a minimum standard VAT rate of 15%. Certain goods, such as food and medicine, may be eligible for reduced rates.

EasyStore allows you to manage VAT compliance for cross-border sales through two primary options:

- One-Stop Shop (OSS) System

- Micro-Business Exemption

VAT Registration Types

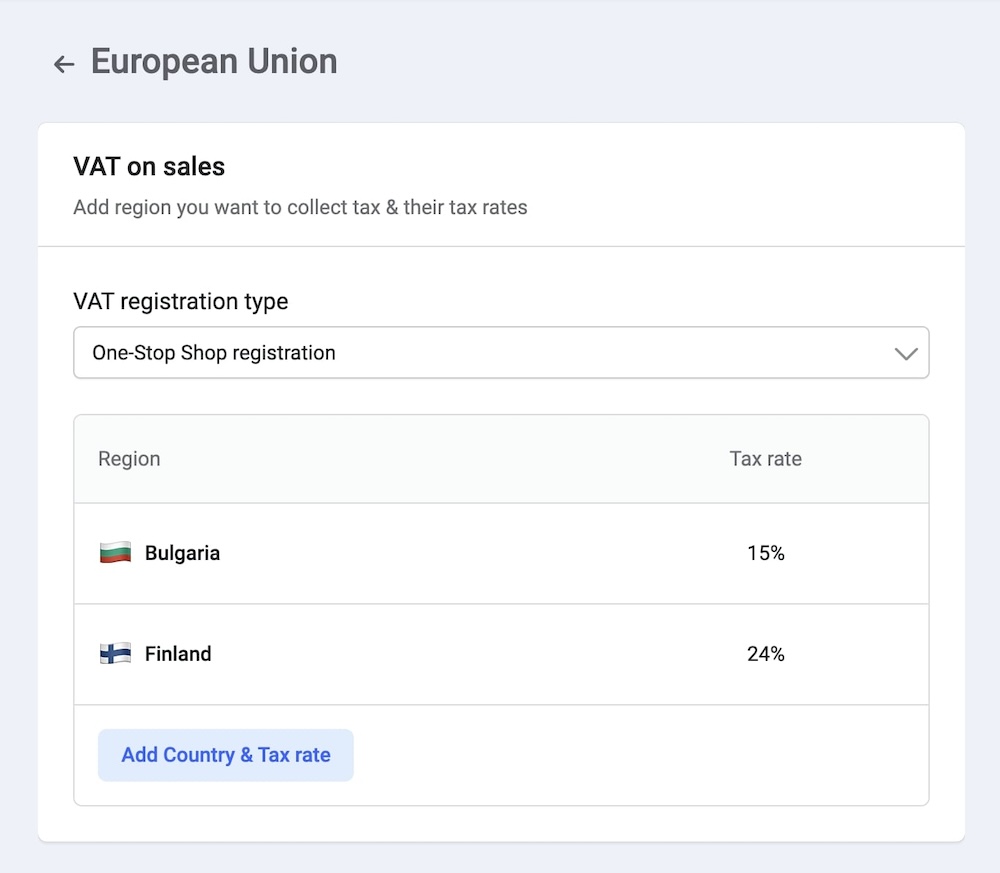

1. One-Stop Shop (OSS) Registration

The One-Stop Shop (OSS) system simplifies VAT compliance for businesses selling to multiple EU countries by allowing registration in one EU member state. Once your cross-border sales exceed €10,000 annually, VAT must be charged based on the customer’s location.

- OSS Features:

- VAT rates are applied based on the buyer’s country.

- VAT returns are filed in one EU country but cover all cross-border sales within the EU.

To Set Up OSS in EasyStore:

From the VAT Registration Type select One-Stop Shop Registration from the dropdown.

Use the Add Country & Tax Rate button to enter VAT rates for each EU country you sell to (e.g., France at 20%, Germany at 19%, etc.).

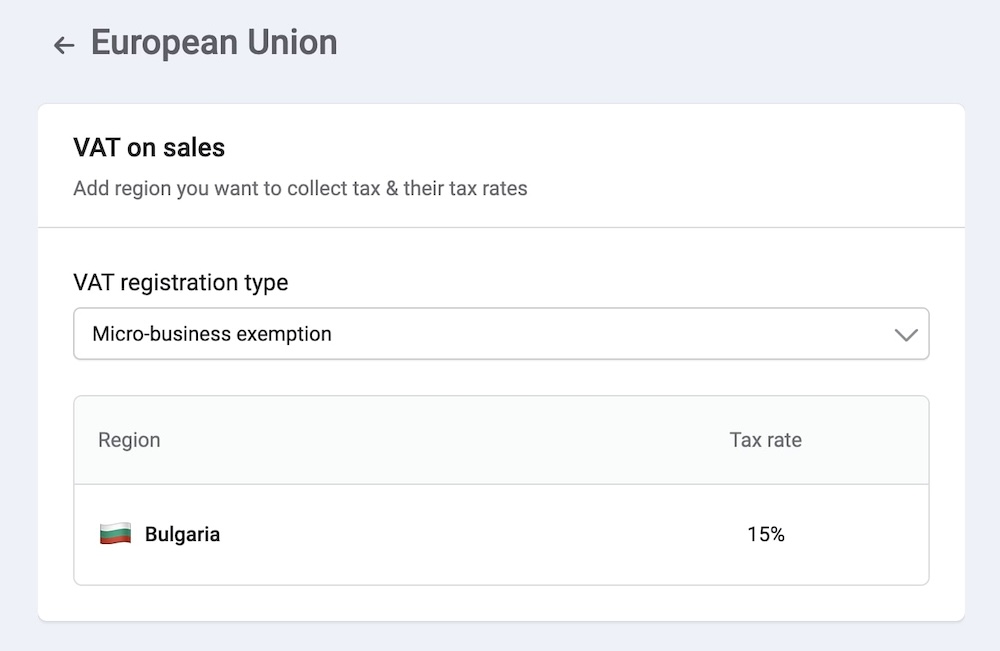

2. Micro-Business Exemption:

For small businesses with less than €10,000 in annual cross-border sales, the Micro-Business Exemption allows them to apply their home country’s VAT rate to all sales within the EU.

- Micro-Business Exemption Features:

- Simplifies VAT management by applying one VAT rate to all EU sales.

- Once sales exceed €10,000, businesses must register for OSS.

To Set Up the Micro-Business Exemption in EasyStore:

- Choose Micro-Business Exemption under VAT Registration Type.

- Enter your home country’s VAT rate, which will be applied to all sales within the EU.

- Update your settings if sales exceed the €10,000 threshold by switching to OSS registration.

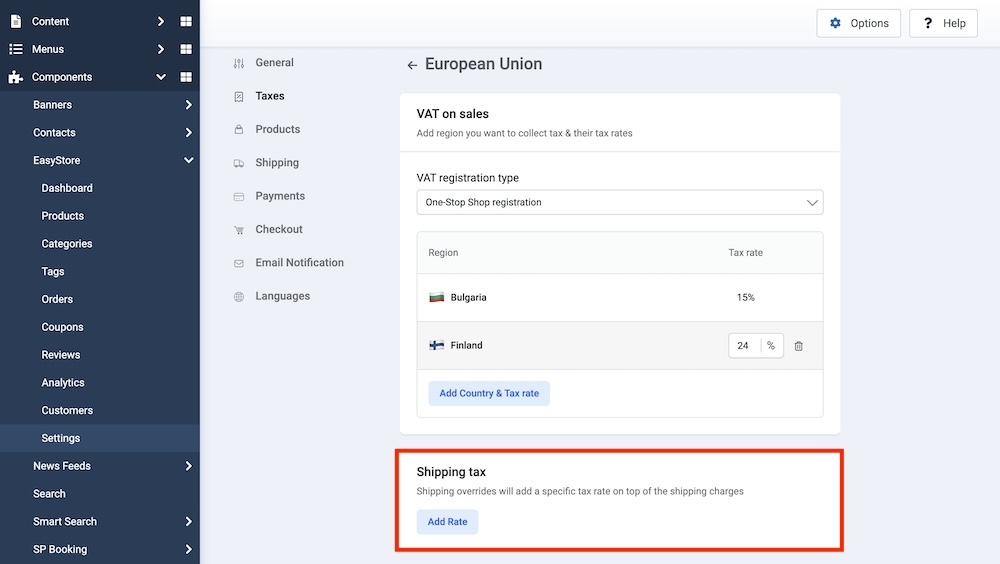

Shipping Tax

Shipping tax applies to the delivery costs associated with an order, based on local VAT regulations. In some EU countries, both the product and shipping fees are taxable. EasyStore allows you to configure shipping tax rates as part of your overall VAT strategy.

Under the OSS System:

You can configure different shipping tax rates for various locations within the EU, allowing businesses to charge appropriate shipping tax based on the customer's location.

Under the Micro-Business Exemption:

You can only set a single shipping tax rate for all shipping activities within the EU. This simplifies tax management for small businesses with limited sales volume.

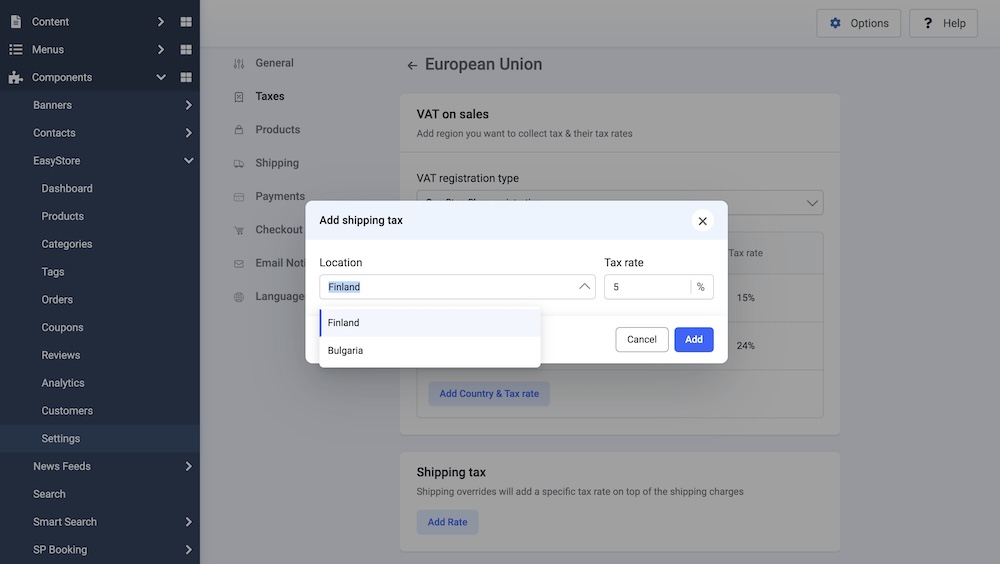

To Set Up Shipping Tax:

- Scroll to the Shipping Tax section.

- Click Add Rate.

- Select the region and enter the tax rate, then click Add.

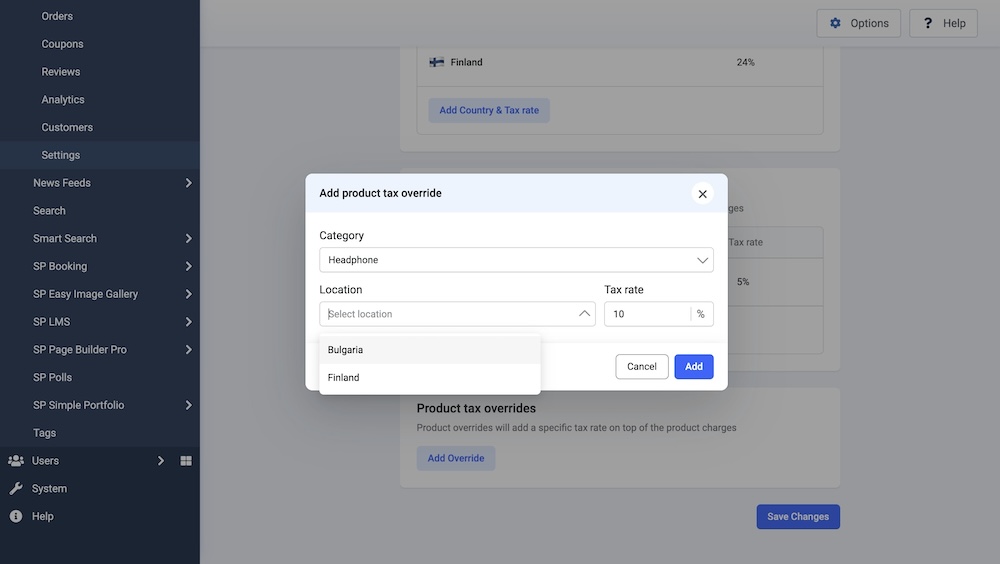

Product Tax Overrides

Certain products, such as essentials or reduced-rate goods, may qualify for VAT rates different from the standard rates applied across the EU. EasyStore allows you to create Product Tax Overrides for these items, ensuring compliance with local VAT regulations.

To add a product tax override:

- Scroll to the Product Tax Overrides section.

- Click Add Override.

- Select the product category and location, then enter the tax rate.

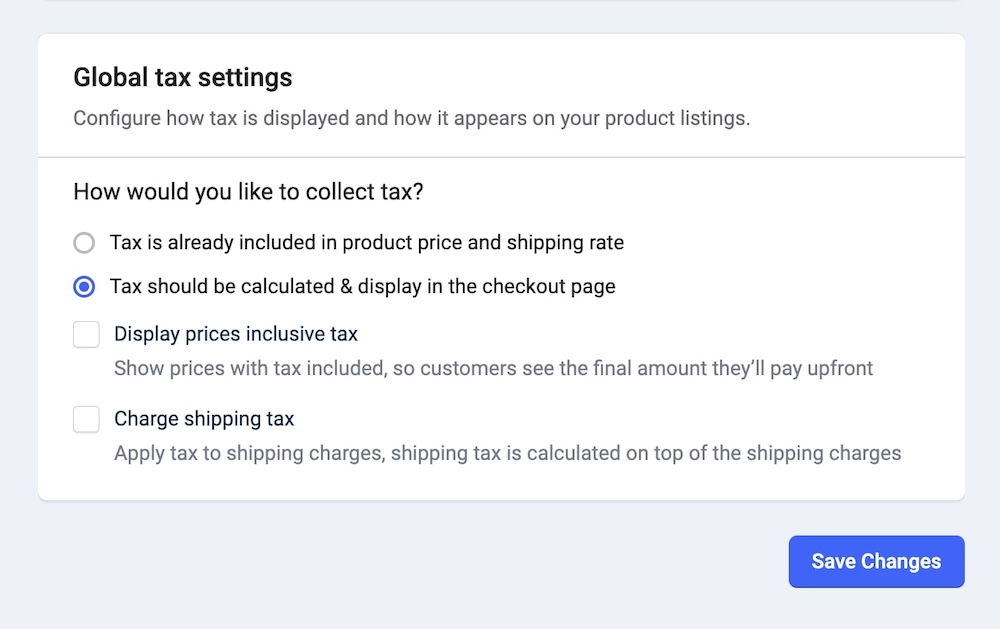

Global Tax Settings

In addition to regional and product-specific tax configurations, EasyStore provides global tax settings that influence how taxes are displayed and applied throughout the customer’s shopping experience:

- Tax is already included in product price and shipping rate: Indicates that product prices and shipping rates already include taxes, providing customers with a clear, final price.

Note: When this option is enabled, ensure you set the tax-inclusive price during product creation.

- Tax calculated and displayed at checkout: Taxes are calculated at checkout based on the customer’s shipping address.

- Display prices inclusive of tax: Ensures prices shown on the site include taxes, even when taxes are added at checkout.

- Charge shipping tax: Adds tax to shipping fees when required by local laws.

How Tax is Displayed for Guest and Logged-In Users

When setting up your store in EasyStore, taxes will be applied differently for guest and logged-in users:

- For Guest Users: If tax settings are configured, the tax rate for the store’s address (as set in the store settings) will be applied and displayed by default. If tax is not configured for the store’s location, the tax rate will be displayed as 0 for guest users.

- For Logged-In Users: Once logged in, users will see taxes calculated based on their shipping location, provided that tax settings are configured for their region. If no tax rate is set up for their shipping location, the store’s default tax rate (based on the store address) will be applied and displayed during checkout.

Seller Tax ID

The Seller Tax ID is the official tax registration number assigned to your business for VAT or GST purposes. It will be displayed on customer invoices and other tax-related documents to ensure compliance with regional tax regulations.

Tax Registration Country

Select the country where your business is registered for tax purposes. This determines the region that issues and validates your Tax ID.

Example: If your business is registered in Germany, select Germany.

Tax ID Number

Enter your official tax identification number issued by the selected country.

Example: For Germany, this could be a USt-IdNr (VAT ID) like DE123456789.

Applicable Regions

Define the regions where this Tax ID will apply. This ensures the correct Tax ID is used depending on your selling regions.

Choose from the following options:

- All countries

The Tax ID applies to all customer regions worldwide. Example: If you only operate under a single EU VAT ID, use this option. - Specific countries

The Tax ID only applies to selected countries. Example: Use this if you have separate VAT IDs for different EU countries. - Countries except for

The Tax ID applies everywhere except for the countries you exclude. Example: If you want the ID to apply to all EU countries except France, select this option and exclude France.