- TemplatesTemplates

- Page BuilderPage Builder

- OverviewOverview

- FeaturesFeatures

- Dynamic ContentDynamic Content

- Popup BuilderPopup Builder

- InteractionsInteractions

- Layout BundlesLayout Bundles

- Pre-made BlocksPre-made Blocks

- DocumentationDocumentation

- EasyStoreEasyStore

- ResourcesResources

- DocumentationDocumentation

- ForumsForums

- Live ChatLive Chat

- Ask a QuestionAsk a QuestionGet fast & extensive assistance from our expert support engineers. Ask a question on our Forums, and we will get back to you.

- BlogBlog

- PricingPricing

How to Simplify Tax Management for Your eCommerce Business

For online retailers, mastering the art of eCommerce tax management is essential not just for legal compliance but also for building customer trust and ensuring business longevity. Implementing effective tax settings for eCommerce can alleviate potential headaches and safeguard your business from costly legal complications.

In this article, we’ll explore why taxes are crucial for eCommerce success, uncover the best practices for setting up tax settings for eCommerce, and how to achieve them effortlessly for your Joomla eCommerce site.

Why Are Taxes Important for eCommerce?

Taxes play a crucial role in the success and sustainability of eCommerce businesses. Understanding tax compliance for online businesses is not just about legal conformity; it impacts customer trust, revenue management, and market expansion. As online retailers navigate the complexities of regional tax regulations for eCommerce, being informed and proactive can help them avoid costly pitfalls and foster growth.

Here are some of the key reasons why tax compliance is crucial for eCommerce:

- Ensuring Legal Compliance: Adhering to regional tax regulations is a legal obligation for all businesses. Failure to collect and remit taxes in the regions where you sell can lead to fines, audits, and other legal repercussions.

- Adhering to Transparent Tax Practices: Consumers are more likely to trust a business that handles tax compliance accurately. By accurately calculating and displaying VAT, sales taxes, and other charges at checkout, you can build a reputation for dependability and professionalism.

- Optimizes Revenue Management with Accurate Tax Collection: Accurately collecting and managing taxes is crucial for maintaining streamlined operations. Businesses that handle taxes correctly ensure they fulfill financial commitments and avoid trouble with the law or unanticipated expenses.

- Expands International Market: Effectively managing international eCommerce taxes ensures compliance with local laws and facilitates seamless cross-border operations. For example, EU businesses must follow VAT rules for eCommerce, impacting pricing and sales. So managing taxes well is key to smooth international operations.

4 Essential Strategies for eCommerce Taxation

Knowing the benefits of taxes for your eCommerce company is not enough; you also need to understand how to manage taxes for an eCommerce business.

Rest assured, as we’ve got you covered with these four essential tax strategies for eCommerce that will not only help you stay compliant but also unlock growth opportunities for your business:

1. Study Local and International Tax Regulations

Each country, and often each state, has unique regulations. For instance, EU countries require VAT to be charged based on the customer's location, while countries like Canada and Australia implement a Goods and Services Tax (GST) that applies uniformly across goods and services. In contrast, U.S. states impose sales tax for online businesses differently, with varying rates and exemptions.

Retailers must research and stay updated on regional tax regulations for eCommerce, which helps avoid penalties while enhancing pricing strategies and customer trust.

2. Utilize Tax Exemptions for Eligible Products

Leveraging tax exemption for online retailers can substantially lower tax liabilities for eCommerce businesses and their customers. Many products qualify for tax exemptions based on local laws, including essentials like food, medical supplies, and educational materials.

By identifying exempt products and transactions, eCommerce retailers can refine their pricing strategies and maintain compliance with local tax regulations. This enhances profitability and fosters customer loyalty by offering more competitive pricing.

3. Automate Tax Calculations for Efficiency

With diverse tax rates and regulations across regions, manual calculations can lead to costly errors and compliance risks. Businesses can simplify their tax procedures by using tax automation for eCommerce or built-in tax management tools for online retailers.

Automating tax calculations for your online store ensures regulatory compliance and saves time while displaying clear tax calculations at checkout. By minimizing manual workloads, businesses can enhance transparency and trust with customers.

4. Conduct Regular Tax Audits and Manage Sales Tax Permits

Regular tax audits are essential for eCommerce businesses to ensure compliance and catch issues early. Establish a routine, annually or quarterly, to verify accurate tax collection based on your sales tax nexus. After identifying your nexus states, register for sales tax permits online, noting that costs and expiration dates vary.

Additionally, you can also use tax compliance software to track permit renewals and reporting requirements. By prioritizing these practices, eCommerce retailers can effectively reduce legal risks, build customer trust, and foster accountability for long-term success.

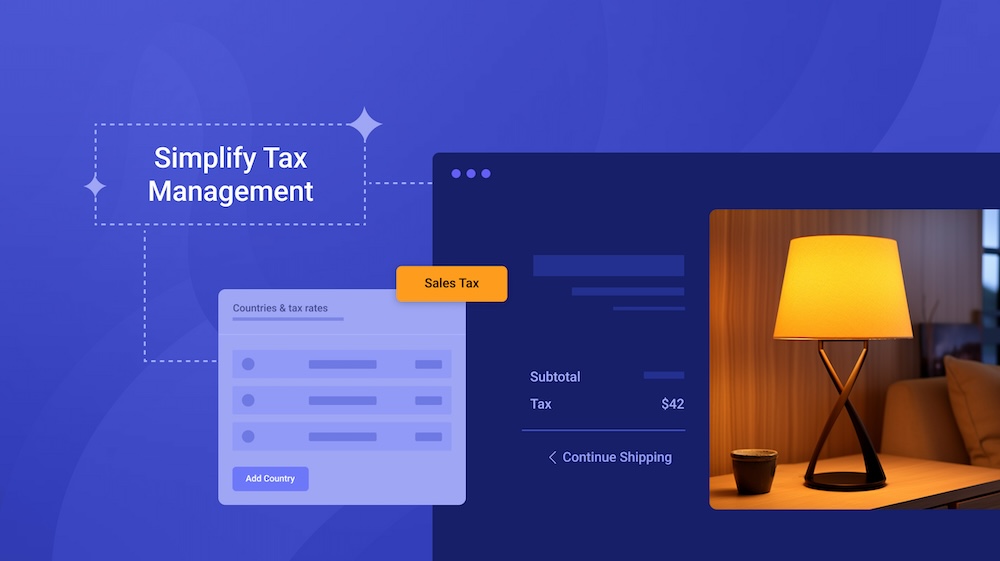

Simplify Tax Management With EasyStore

Managing taxes for your eCommerce business can be complex, but with the right tools, it becomes far more manageable. This is where EasyStore comes into play.

Whether you need to set up regional taxes or configure VAT for EU eCommerce, EasyStore offers customizable solutions for compliance. These features ensure your Joomla eCommerce site operates smoothly and efficiently.

Here are five key EasyStore tax features that can help you manage your tax obligations effectively by implementing the aforementioned strategies:

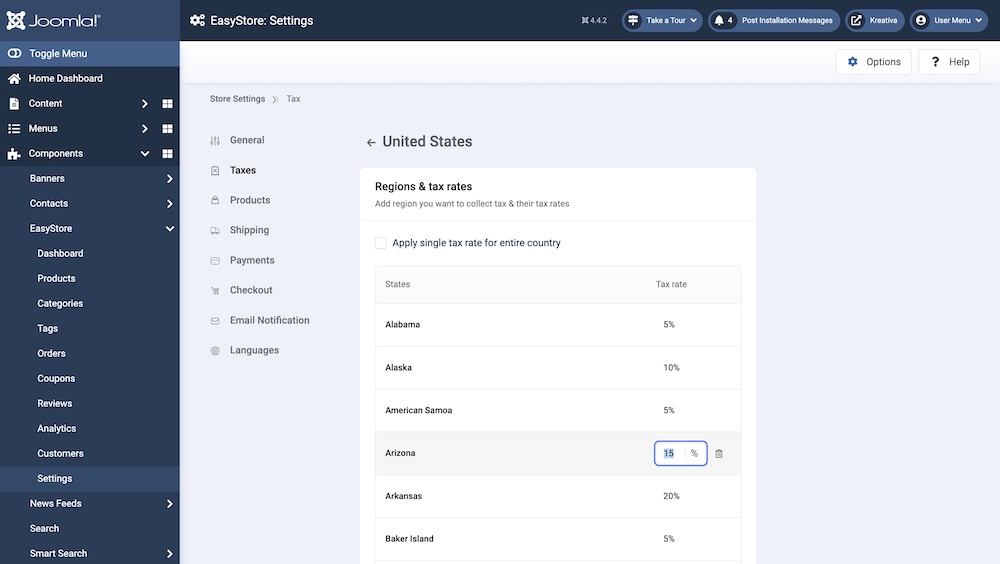

Customizable Regional Tax Settings

EasyStore allows you to set up customized tax rules for different regions, ensuring compliance with regional tax regulations for eCommerce. Retailers can define tax rates based on geographical location, ensuring compliance with local sales tax, VAT, and GST requirements. This flexibility is crucial for managing taxes accurately as your business expands into new markets.

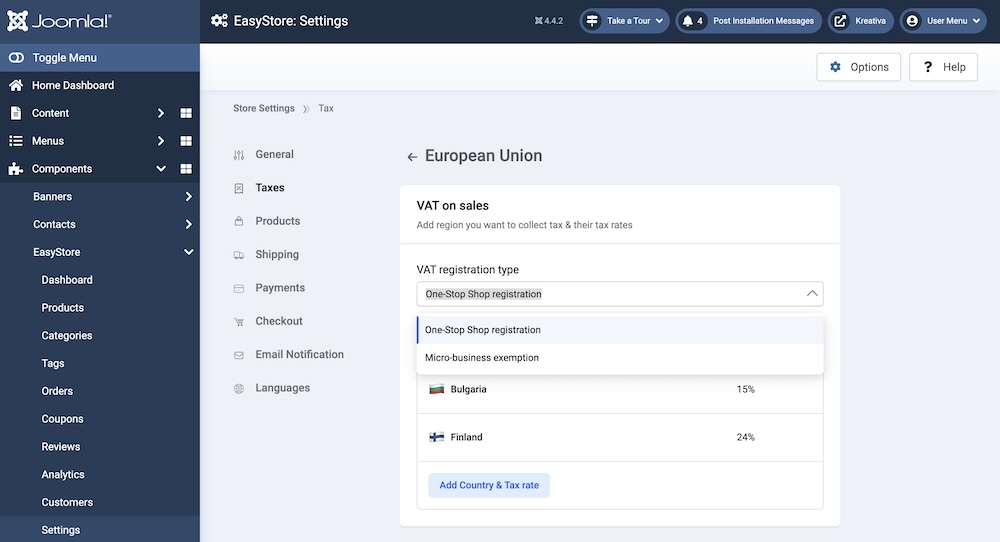

Tailored Tax Settings for the European Union

EasyStore has integrated powerful features to ensure compliance with VAT regulations for businesses selling within the European Union (EU). This allows you to easily configure tax rates in line with the EU's complex distance selling rules, making cross-border sales more efficient.

With built-in support for the One-Stop Shop (OSS) system, you can seamlessly handle VAT registration and reporting across all applicable EU countries from a single location.

Additionally, the platform supports the Micro-Business Exemption, enabling smaller businesses to take advantage of VAT relief measures. This comprehensive approach helps businesses of all sizes stay compliant while expanding into EU markets.

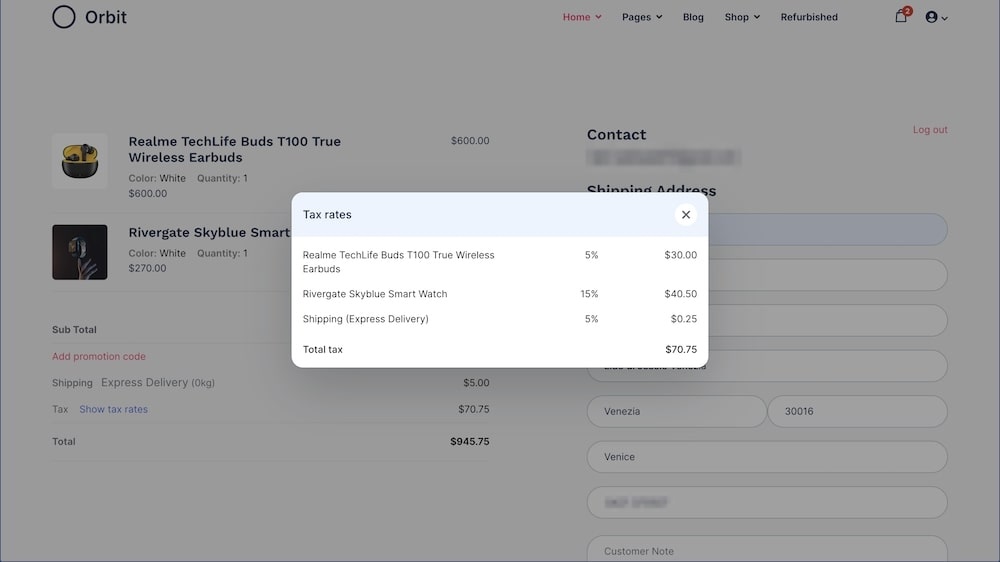

Automated Tax Calculations at Checkout

EasyStore automates tax calculations, allowing eCommerce businesses to minimize errors. Once you’ve set up the tax settings, EasyStore ensures that the correct rates are applied for every transaction, offering transparency and accuracy for both you and your customers.

After you have configured your tax settings, any customer who makes a purchase on your site will be able to see all necessary tax calculations during the checkout process. This facilitates clear transparency of charges for the customer.

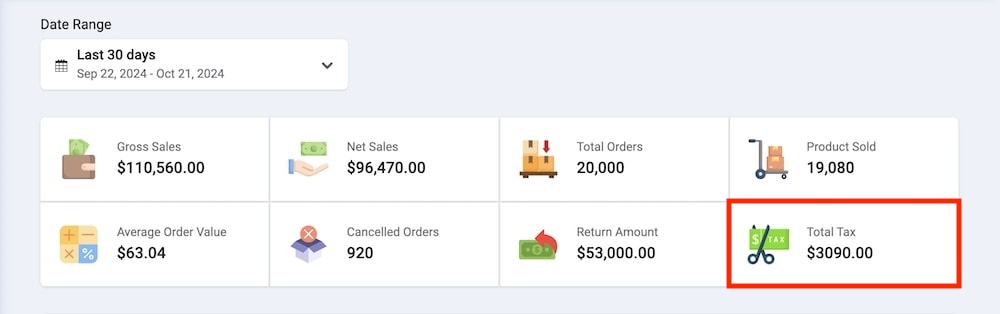

Effective Sales Tax Management With EasyStore Analytics

EasyStore's Analytics feature helps manage sales tax nexus and other tax obligations. With EasyStore’s robust analytics tools, businesses can make informed decisions that keep them on top of their tax obligations while streamlining their overall operations.

The Analytics dashboard also displays a detailed tax overview graph, enabling you to properly manage your revenue in conjunction with other expenses and earnings.

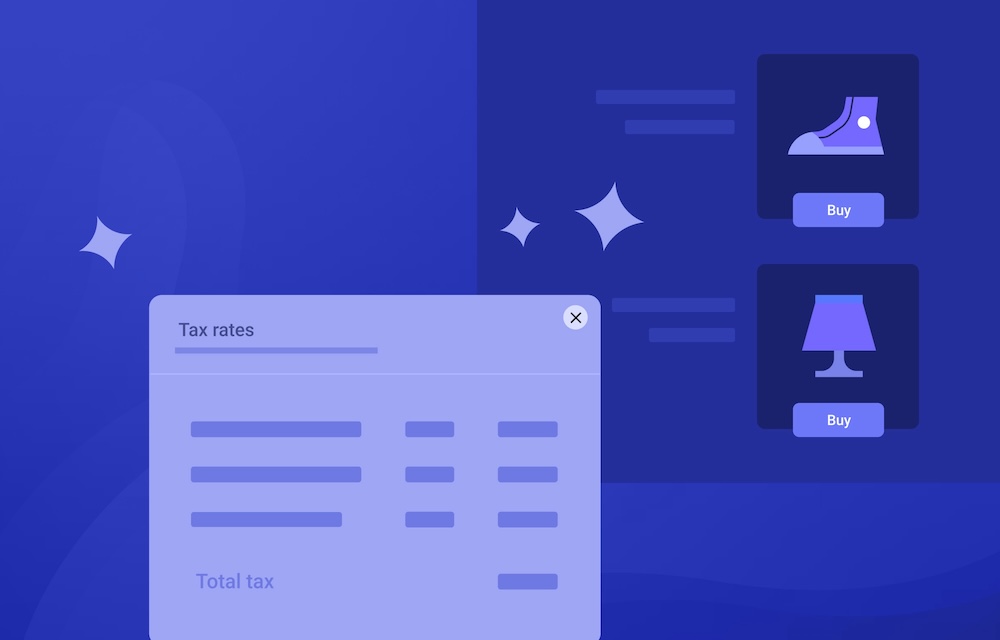

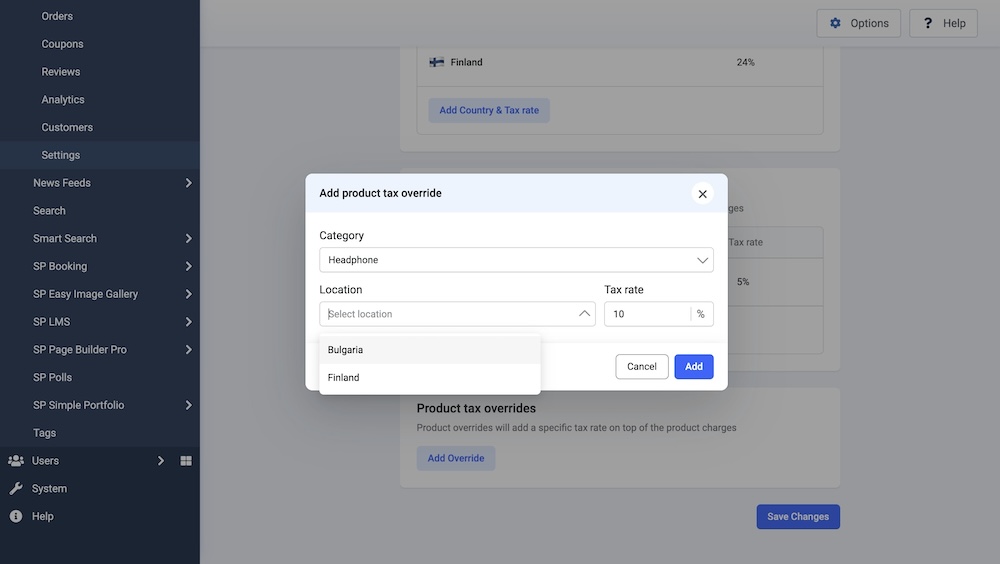

Streamlined Product Tax Management With Product Tax Overrides

EasyStore enhances eCommerce tax management for online retailers by enabling you to implement Product Tax Overrides for items that have VAT rates differing from the standard rates across various regions. This feature is especially advantageous for essentials and reduced-rate goods, ensuring full compliance with regional tax regulations for eCommerce.

With Product Tax Overrides, you can accurately define the tax treatment for individual products, taking into account any applicable additional product taxes. This level of flexibility not only safeguards your business's tax compliance for online business but also enhances your pricing strategy.

Learn more about EasyStore’s diverse tax settings in our detailed documentation.

Summary

By utilizing EasyStore's tax management features, eCommerce retailers can streamline eCommerce tax management and ensure tax compliance for online businesses.

Whether you're just starting out or looking to enhance an existing store, EasyStore simplifies the entire taxation process by offering all the required tax management tools for online retailers, such as customizable regional tax settings, real-time automated calculations, tax exemption options, and advanced analytics.

Start using EasyStore today and take control of your eCommerce success with ease and confidence!

There are no comments posted here yet